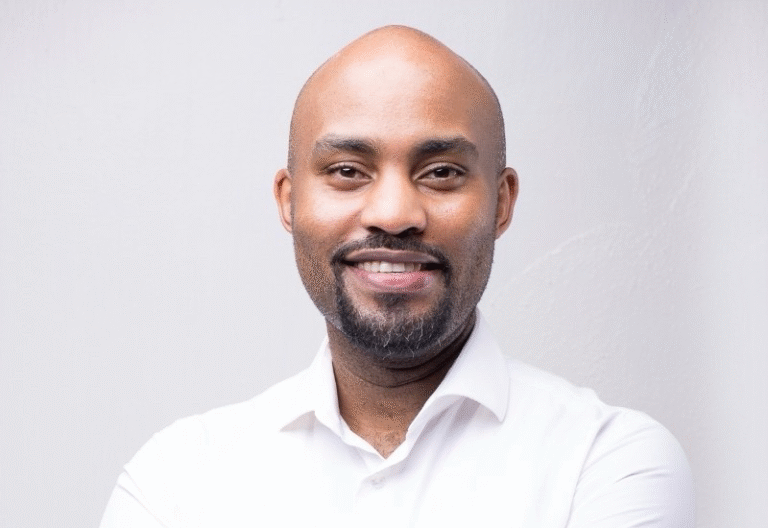

Shaping EA Fintech: Insights From Kiptum Kidombo

There is no denying it – fintech in Africa is dynamic, especially with the main players growing exponentially as well. Yet another undeniable factor about the fintech evolution in Africa: one can’t talk about it without mentioning Flutterwave, the continent’s first unicorn. Surrounded by controversy over regulation, the fintech start-up has beaten all odds to scale, becoming a global fintech player in due course.

In this evolving fintech space, few voices resonate with as much authority and insight as this unicorn’s Senior Vice President for East Africa, Kiptum Kidombo. Kidombo, also a board member of the Association of Fintechs in Kenya (AFIK), comes with a wealth of experience spanning banking, gaming, and fintech. His journey is as dynamic as the industry he helps shape.

Our conversation with Kidombo gleans from his experiences and insights from his short tenure at Flutterwave so far, reflecting on the company’s growth, challenges, and impact on the East African fintech landscape. He discusses the region’s rapid adoption of digital payment solutions, the crucial interplay between banks and fintechs, and his predictions for the future of financial technology in East Africa. He also opens up about his journey in his role as a professional coach, mentoring young leaders in the banking and fintech space in East Africa.

Let’s start with getting to know you first. Who is Kiptum Kidombo?

Kiptum Kidombo is a business leader in the fintech industry, currently serving as Senior Vice President for East Africa within Flutterwave. I’m also a board member of the Association of Fintechs in Kenya (AFIK) and very much involved as far as activities within the fintech space are concerned, as a thought leader as well. My background is in banking, with 13 years of experience in the banking sector, having transitioned from that into gaming, and now I’m in the fintech space. The other hat I wear is that of a professional coach. I work very closely with fintech leaders transitioning into higher responsibility to help them realise their full potential. Aside from that, I’d say I’m a proud father of two boys and a girl. I’m also a sports enthusiast with an interest in golf and cycling. I guess that’s just about that.

You’ve been at Flutterwave for almost a year now. How has the experience been so far?

Oooh? It’s been a year? Honestly, it feels like I’ve been here for a lot longer than that. I think the experience is very dynamic, especially at a unicorn such as Flutterwave. For me, the experience has been very eye-opening, having to understand the dynamics, not just of the company, but also the influence the company has on the overall industry, especially the East African space. We have a very broad and robust product offering across the region. Having been licensed in Rwanda, Tanzania, and now pursuing our licenses in Kenya and Uganda. So, it’s been a very interesting journey just to learn the rigours of the organisation.

Wow, it’s only been 11 months, actually, about to clock a year.

Having worked in the fintech space in East Africa for years, how can you describe the growth of fintech in this region in comparison to other regions on the continent?

East Africa, I’d say, has a massive proliferation of digital payment solutions. One of the things I’ve noticed is that, even away from the payments space where I play in, the digital lending space has over 300 applications at the central bank. It tells you what level of interest there is in terms of the solutions that are available and the solutions that are coming into the market. The benefits of that come from the fact that there’s a growing population, especially a young population that’s tech savvy. These are individuals who are eager to embrace technology, and it’s evidenced by the fact that if you look at the rise of mobile payments, mobile money specifically, East Africa led from the front and has continued to do so from as far back as 2007. Look at the rise of M-Pesa, for instance, before banks came in with their digital solutions as well.

It is a space that has been served by the fact that you’ve got a lot of tech-savvy young people who want to explore and experience new technology. We embrace it faster than other markets, judging from my experience in the region. Some solutions have been tried in Southern Africa and failed, and others have been taken to Western Africa and still failed. From a global perspective, you’ll find that some of the things we’re able to do on digital payments in East Africa cannot even be done in countries like the US and some parts of Europe. I think in addition to that, it has presented big opportunities for tech investors to invest in the region.

We have invested a lot of funding into not only the whole of Africa, but into the region as well. We’ve got Kenyan, Tanzanian, Rwandan, and Ugandan tech entrepreneurs who have attracted funding to build their solutions from private equity firms and venture capital. This just tells you the scale and size of the space and the ability of that space to grow. Opportunity in terms of investors plus the tech start-ups themselves, is definite proof that this is a much larger landscape.

From the AFIK perspective, our job and sitting on that board has been to create that opportunity to understand the market better. We’re moving into things like capacity building, having just partnered with Moringa School to bring up that level of capacity building because we’ve seen how big the space is growing in the region and the fact that there’s need for even much bigger talent.

What is your outlook and prediction of fintechs in East Africa, and what role does Flutterwave play in this?

We’re already playing a part as Flutterwave, and the part we are playing is that we are an African-founded start-up. Coming into the East African region has also given us an opportunity to showcase the kind of solutions that we can create for the problems that exist. For Flutterwave specifically, because of our global presence, we’ve been able to bring global merchants to acquire payments in East Africa. Take, for instance, Uber; we process payments for the company, and with this, we have played a part in its ability to scale and even operate in the East African market. My prediction for fintechs overall leans into how it’s important to mention that the sector is evolving in the East African region. It is evolving in the sense that we’ve seen start-ups come up and drop off, but then again, we’ve also seen some that have ended up thriving. There’s a lot of popularity in terms of what different solutions can do.

I remember I was sitting on a panel discussion at the Safaricom Innovation Week, and we were discussing Web 3.0 and asking the question, what is it that can be done past what we already have in the region. We are seeing an evolution from just the normal send money and merchant payments into sectors of the economy. We are seeing agritech startups that are coming up and providing solutions for the farmer. I recently had a conversation with a very young individual, about 25 years old, who has come up with a solution called Lipa na Chai. You know? It’s such an interesting solution because he’s targeting tea farmers to use their stock to actually make payments.

The impact fintech has had in the region is being felt in other sectors as well, including InsureTech and banking. Our role in the region, not only as Flutterwave, but fintech space as a whole, is to innovate around the lives of the customers. My outlook is that as long as we keep moving away from just building tech to solve customer needs and problems, the industry will continue to grow.

Inasmuch as fintech is growing in Africa, do we have any shortcomings that are slowing its growth on the continent?

Well, would it really be an industry without shortcomings? Off the top of my head, I’d pick out two or three.

The first one is the challenge around the regulatory framework in Africa. In most cases, innovation has led to regulation, and we have found ourselves as an industry having to engage with regulators a lot more intently to be able to get our solutions out in the market. It is not a Kenyan or South African problem; it is a problem across the globe, but largely in Africa, because this is where the innovation is happening. The biggest challenge has been to get the regulator to understand exactly what you are doing. How are you mitigating the risks? How are you protecting customer funds? How are you making sure that you do not allow individuals who are out to compromise the financial system to actually use your rails? How are you safeguarding?

One of the things that the central banks across the region have done is to ensure that before they license you, you must have a money laundering reporting officer who’s qualified to be able to provide assistance for you. The shortcoming is not so much the regulator, but it is the fintechs themselves, not understanding how well they need to manage the risk for it to be a sustainable business.

The second shortcoming is the race for talent. There’s a huge talent war going on. I recall a CIO100 Symposium Fireside Chat at Whitesands with a panel on talent wars, and it was a very heated panel. This was just the depiction of what is happening in the industry.

Banks or Fintechs? Do you think that fintechs can grow to come and completely replace traditional banks?

I think you are trying to fix me with that question. (Laughs). I would change that question; it is not banks or fintechs, it is banks AND fintechs. The reason why I say this is that it is a symbiotic relationship. None can exist without the other, unless banks convert to fintechs and fintechs convert to banks. Each of these solutions, each of these companies is solving problems, and they need each other to solve those problems. The bank, in its traditional sense, is a secure place to keep your money and use that money to borrow, perhaps to develop yourself. Fintechs, on the other hand, are providing rails for customers, for people to be able to move money from one point to another much faster and easier, while also providing security.

Remember that no fintech can exist without the holder of the value, the person who is licensed to hold that value, and that is a bank. This is why every fintech in any market must find a bank partner to be licensed, because transactions must be settled into a bank account, which is licensed as a bank. If you look at the trend today, banks are setting up fintechs. Some are actually incubating fintechs to provide solutions because fintechs innovate faster. Fintechs are moving quickly in terms of their ability to innovate and build. Fintechs are also going outside of traditional financial services.

You cannot separate the two.

Do you think banks see you as competitors?

To some extent, yes. It’s a challenge. They may do. Hence, some banks are setting up fully-owned fintech subsidiaries. They may have a view that we could be competing with them. But I wouldn’t say that they’re seeing us as competitors. They’re probably seeing us as an opportunity in this sense. They’re not seeing fintech as a competitor. They’re seeing the fintech space as an opportunity that they could also tap into. So they say, instead of me collaborating with fintech X, why don’t I set up my own? Understand? They’re tapping into that opportunity. Because I can’t say that we’re entirely taking the services that the banks are offering. You can’t replace a bank.

In your fintech journey, what has been your proudest moment?

My proudest moment is continuous, in this sense. I am a professional coach. I have taken a course to be a certified professional coach. Before I even did that, and the reason I went into it, the thing that moved me to actually take a course eventually is, I realised that I had a pool of young leaders that I was mentoring over time. Some of them have gone out to grow and become heads of departments, managers in the digital space, or at banks. I still mentor some of them. I’m very proud to see these individuals take up leadership responsibilities in their specific spaces, especially in the digital space. When we started the digital department at Family Bank, I had a team of 17. Out of that team of 17, I can pick out about 10 who are leading digital departments in banks today. This is just barely five, six years ago.

In your short tenure at Flutterwave so far, what has been your proudest moment?

That would be pretty obvious. My proudest moment is 9 November 2023, when we, as Flutterwave, were exonerated by the courts for any wrongdoing in a case that had dragged on for nearly a year. It was a testament, a true testament to the fact that we won. We are a company that is very keen on matters of risk, compliance, and all that. If you follow the case and the ruling that came out of it, it was clear that Flutterwave did no wrong as far as the case that was levelled against us was concerned. I think I was about five months old at Flutterwave when that happened. It was a very proud moment. Although that happened in Kenya, it allowed us to re-engage our customers, our merchants, especially in the region. Because what happens in Kenya affects the perception that we have in the region. Kenya is a leading market as far as the fintech space and financial services is concerned.

We are licensed in Rwanda and Tanzania, it now given us a lot of confidence to go into those markets and engage our customers a lot more proudly and tell them that, as much as the case was there, this is the truth around what was happening. Literally, it legitimised us in those markets and allowed us to re-engage and offer our services to the region as a whole. We’ve seen tremendous growth after that in terms of the acceptance and the engagement that we’ve had with our customers. Hopefully, the next step for us is to be licensed in Kenya so that we can fully offer our services in this market.

In your career, do you have an example of a project you were part of that didn’t achieve what it was set out to do? An example of a project that failed, and you got a lesson from.

Well, failure is part of learning. I’ll go back to 11 years ago. I’m choosing this because it’s the first opportunity I had to work on a fintech-related project. I was working in a bank at the time, and was tasked to project-manage the first-ever mobile lending solution by the bank. Mind you, this was before even the M-Shwaris and KCB M-Pesa loans were launched. Before digital lending became what it is today. We came up with a product called PesaMob and had a team of developers and project managers working on the project. We worked on it and tested it. It was a USSD-driven solution, and we aimed to enable users to access money from that platform based on their transaction history with the bank and even from their M-Pesa. We had a very well-integrated system and did a big launch with the Central Bank of Kenya as well. Barely a month into offering services, we were hit with major fraud. There were so many loopholes in the system, and we had to shut down the product. Unfortunately, we never revived it. That was very disheartening because shortly after that, KCB M-Pesa and M-Shwari launched. After they launched, digital lending just exploded. We had a product that could have led the market, but unfortunately, we did not see the full potential that it could have.

When I look back, I think there were many key learnings from that. One, that sometimes innovation can lead to certain fundamentals that can lead to failure. Some of those fundamentals were a risk management framework, which was how we had safeguarded the back end to avoid any. Honestly, it was just a hack, and it made it very difficult now for the bank and the board to approve another lending product until much later. Today, that product was rebuilt after I left the bank, and luckily by someone I had mentored, and they saw that project to fruition. Today, the bank does have a mobile lending solution, with another name, of course, but offering the same solution. The only issue was that it was launched after digital lending had grown, when it could have led the trend.

What is the one thing people don’t know about you? That’s an easy question, yeah?

There are many – let me think! People do not know that I collect art. Actually, I collect art from very little-known artists in Nairobi, not the major players. Of course, I have pieces of art that I’ve bought from known artists, but I always seek out art from painters who are not widely known. I’ve even gone a step further and set up an online art gallery to promote these artists.

What do you do in your free time? What are your hobbies?

Surprisingly, I actually like to hibernate. There’s a misconception among people who know me very well that I am extroverted, but I do enjoy a lot of my quiet time. You’ll find me at home in my garden, just spending time with my dogs and my kids. Outside of that, I cycle. I’m part of the joyriders cycling club, based out of Karen. I quit rugby after I broke my hand and moved to other sports. I’m also, of course, an avid golfer who plays at Karen Country Club.

Where do you see yourself in the next five years?

I see myself having grown tremendously as a thought leader in the market. One of my greatest opportunities has been joining the board of AFIK, which has given me a platform to continue to lead thought. I aim to increase the level of impact I have in the market as a thought leader and expert. In five years, I also see myself celebrating the wins of the things that we are doing now. Some of those things include what we are doing at Flutterwave to grow the industry and to get fully licensed in the markets where we are chasing our licenses. We’re a unicorn, and we hope to continue being as big as we can get. However, not just big for the sake of being big. I see us having developed a lot more impactful solutions for the problems facing Africans daily.

This article was first published in the June 2024 edition of CIO Africa Magazine.